Obituary

Monday

24

April

Graveside Service

2:30 pm

Monday, April 24, 2017

Mountain View Cemetery

5000 Piedmont AVe

Oakland, California, United States

Service Time: 02:30 PM

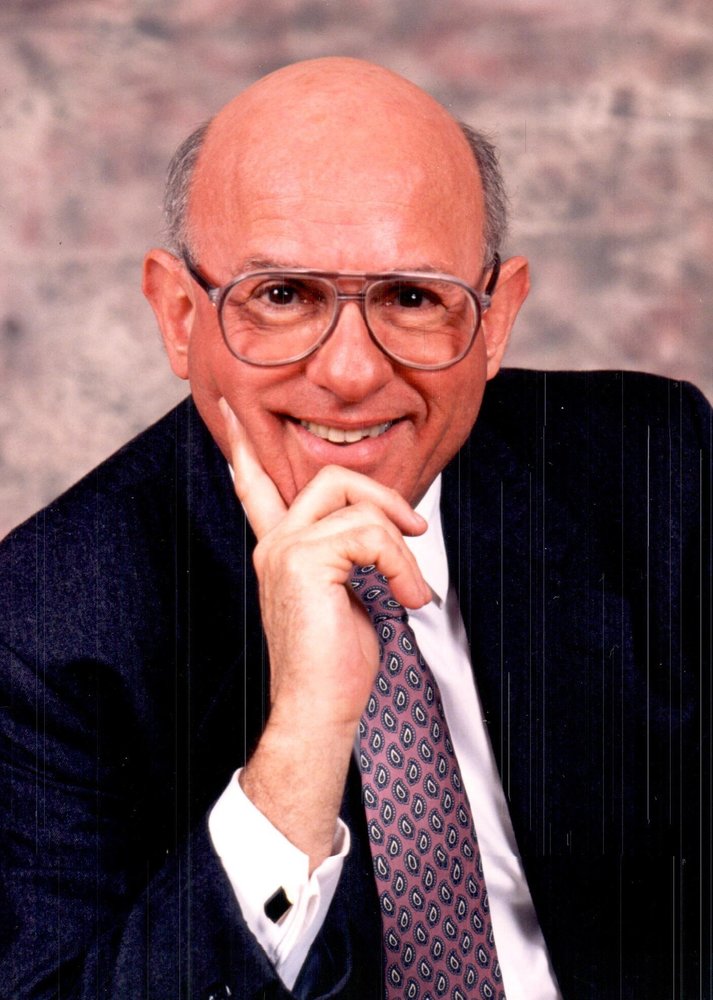

Obituary of Graef Slater Crystal

Graef “Bud” Crystal, who for more than 40 years designed compensation packages for some of America’s top corporate executives and then did an about face and became a feisty critic of how and what companies pay senior executives, died Tuesday. He was 82.

Crystal died at his home in Las Vegas from heart problems, said his wife, Sue.

During his career as a compensation expert, Crystal worked with the CEOs and senior managers of many of the Fortune 500 companies, including American Express, Coca-Cola, Squibb Corporation, General Electric and Eastman Kodak. In the late 1970s he was the New York Stock Exchange’s compensation consultant and designed its first incentive plans for CEOs.

As a designer of compensation packages that included incentive bonuses, stock options, pension benefits and more, and then a critic, Crystal was treated as a guru on executive compensation. He was regularly contacted by reporters for comments on executive compensation, appeared on “60 Minutes”, “Charlie Rose” and others.

In 1989, Crystal stopped being an executive compensation consultant and took on the role of a pugnacious critic, analyzing executive pay for media, including Fortune and, most recently, Bloomberg News as a columnist.

When he became a critic of those packages, he used the same formulas and more to determine if higher pay also meant higher shareholder returns. His conclusion: pay for performance was often fiction, and he singled out CEOs by name.

Crystal maintained that CEOs should be paid based on performance, that they should get a boost when the company’s performance improves and a pay cut if the company’s performance stumbles or falls. “Shareholder return is the best determinant of pay because it’s the only gauge of success that’s external and can’t be manipulated by accounting tricks or shifts in performance targets,” Crystal said.

He called his second career as a compensation critic “atoning for my sins.”

“My switch from henchman to gadfly incensed many CEOs, some of whom called me a Judas and asked where they should deliver the 30 pieces of silver. In a sense, though, those CEOs and I were operating on the same wavelength. They were quoting from the Bible, while I was beginning to think seriously about the need to save my immortal soul,” he said.

Throughout his career, which began in 1959 after he saw an ad for a wage and salary analyst in The Los Angeles Times, Crystal said he noticed that CEOs rarely saw their pay package reduced when their companies’ stock plummeted.

He was the author of six books, including in 1991 the best-selling “In Sear of Excess: The Overcompensation of American Executives.”

A modern CEO, he wrote, was “a cross between the ancient Pharaohs and Louis XIV –an imperial personage … he is paid so much more than ordinary workers that he hasn’t got the slightest clue as to how the rest of the country lives”.

But Crystal also admitted to having been part of the problem: “I helped create the phenomenon we see today; huge and surgin pay for good performance, and huge and surging pay for bad performance, too.”

The book was praised by then-presidential candidate Bill Clinton as a “wake-up call to the corporate world.”

A New York Times’s reviewer wrote:

“Mr. Crystal concludes that the system is ‘rotten to the core,’ though he is quick to confess that as a corporate pay consultant he helped create the problem. Now he is trying to right the wrong by working for shareholder groups and by writing articles – and ‘In Search of Excess.’ The result is a highly informative, very readable indictment of executive pay in the United States, larded with instructive examples.”

Asked why he thought CEOs didn’t like people criticizing their pay packages, Crystal told Charlie Rose in an interview in June 1992: “Some of the things I’m saying will result in having their pay slashes; which is roughly the equivalent of trying to take a piece of filet out of the jaws of a Doberman who hasn’t eaten for a week.”

Crystal didn’t limit his criticism to occupiers of the “C suite”. He took on the chief financial officers, chief operation officers, chief legal officers, board compensation committees, the Financial Accounting Standards Board, the Securities and Exchange Commission and even compensation consultants.

His writing were full of numbers and formulas, and throughout them Crystal wove his wit and own lexicon.

In a study comparing the compensation of British and American CEOs who headed comparable companies and delivered comparable results, he wrote: “You would always want to hire the Brits. They deliver the same results for less money. And besides, they speak better English.” On a major company replacing its retiring CEO with one from another company, Crystal wrote: You paid a Cadillac price for a Chevrolet, and the Chevrolet turned out to be a lemon.”

And one of the most used terms was: “He is a porker of the first order.”

When he wasn’t criticizing CEOs with huge compensation packages, he targeted boards of directors who gave them the pay.

‘Many CEOs decide on what they perceive to be a fair level of pay, add $10 million to give themselves some maneuvering room, and then present their outsized demands to a board of directors that they hand-picked,” he said. ‘Typically, some 60 percent of these directors are CEOs of other companies, and none has a known aversion to agreed.”

While Crystal tossed his barbs at many CEOs and others, he also has his “heroes”, CEOs who had been paid too little for what he called “magnificent contributions” to their shareholders. They included Intel’s Andy Grove, Berkshire Hathaway’s Warren Buffett and Microsoft’s Bill Gates.

No matter how entertaining he would make his barbs, the former clients and even those he never worked for didn’t take kindly to his criticisms. Some called his compilation of data inaccurate; others tossed unprintable responses his way.

Some called him a Judas for being a part of the system for so long and then turning on it. His response was that he preferred to be compared to Mary Magdalene in the second phase of her life. “Maybe I was a hooker,” Crystal said. “But I’m hoping to end my life as a saint.”

After Crystal stopped writing, he turned to the piano for relaxation. ‘I was trained as a classic pianist since I was four and a half,” Crystal explained. “I have a Steinway grand piano and high ceilings. I enjoy my time these days with people like Mozart, Bach, and Chopin.”

Crystal was born on April 30, 1934, in Oakland, California. When his parents died, an aunt and grandparents enrolled him at San Rafael Military Academy in California at the age of 10. He was there from 1945 to 1950, and then graduated from Oakland High School in 1952. In 1956, he received a bachelor’s degree from the University of California, where he later was an adjunct professor, and a master’s degree from Occidental College in 1962.

He is survived by a daughter and two sons from a previous marriage; Allison Taliercio of Dunedin, Florida, Matthew Crystal of Redmond, Oregon, and David Crystal. He also had three stepchildren from another marriage; Chad Cunningham, Amy Breninger, and Jamie Baker, all of Santa Rosa, California. He had 12 grandchildren and one great grandchild.

Personal service begins with one call:

If someone has just died or if you need to make funeral arrangements, please call us right away--we answer the phone day and night. (702) 208-9688

stay informed

Email*:

Name*:

Message*:

Please enter the numbers and letters you see in the image. Note that the case of the letters entered matters.*:

There are some invalid fields.

Please wait...

Message has been successfully sent.

location

Kraft-Sussman Funeral & Cremation Services

3975 S Durango Dr Ste 104

Las Vegas, NV 89147

Phone: (702) 208-9688